- CIW News

- Posts

- 15 Jul 2024

15 Jul 2024

CIW News is a free email newsletter on China tech trends.

The overall market size for commercial service robots in China is approximately 1.38 billion RMB, marking a 17.6% growth compared to 2022, indicating a market rebound.

The primary products in the Chinese commercial service robot market are restaurant delivery robots, hotel delivery robots, commercial cleaning robots, and guide robots. Other product types include outdoor delivery robots and disinfection robots.

Market share of commercial service robot products in China in 2023:

Food Delivery Robots: 43.6%

Hotel Delivery Robots: 36.1%

Commercial Cleaning Robots: 13.5%

Guidance Robots: 4.9%

Others: 1.9%

Autonomous Driving

IDC Highlights Autonomous Driving Technology Advancements

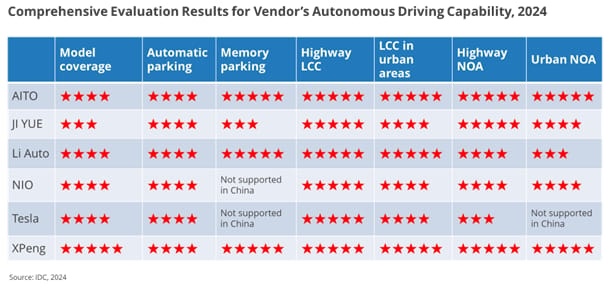

The new report from IDC China, “Autonomous Driving Capabilities Assessment, 2024,” delves into the progress of autonomous driving technology and evaluates the features of six major vehicle brands.

“The competition in the China autonomous driving market will intensify. Establishing a competitive edge will depend on long-term investment in autonomous driving R&D, effective data asset management, and continuously improving product performance and reliability.”

IDC’s evaluation focused on the enhanced ADAS features of six major vehicle brands in China: AITO, JI YUE, Li Auto, NIO, Tesla, and XPeng. The assessment considered advanced features such as parking, Lane Centering Control (LCC), and Navigate on Autopilot (NOA).

E-COMMERCE | CIW Subscription

Chinese Companies Making Waves in the Middle East E-Commerce Market

Saudi Arabia, with a population of approximately 37 million, boasts a high internet penetration rate expected to reach 96.44% by the end of the year.

The government plans to invest over $100 billion in developing logistics infrastructure and online payment systems to boost e-commerce growth. The region’s demographic, with a significant proportion of young women, has strong purchasing power comparable to that of the US.

The cultural and logistical differences necessitate a tailored approach to influencer marketing in the Middle East. Chinese MCN companies are finding that strategies successful in other regions, such as focusing on entertainment to drive traffic, may not directly translate to the Middle Eastern market.

Understanding the cultural significance and consumer preferences in the region is key to driving sales.

Mother and baby products also found a strong market due to Saudi Arabia’s family-friendly policies, including support for multiple marriages and substantial state-provided benefits for children…

Also on e-commerce: Chinese e-commerce giants achieved an annual revenue growth rate of 41%

Recent reports highlight that after receiving assistance from Pang Dong Lai, Yonghui Supermarket saw its first-day post-adjustment foot traffic multiply by 5.3 times and sales by 13.9 times.

Hunan’s Bubugao Supermarket also experienced record-breaking foot traffic and daily sales, with the latter reaching over a million yuan on the fourth day post-adjustment, a 6.7-fold increase compared to pre-adjustment figures.

Similarly, Guizhou’s Heli Supermarket reported a first-day post-adjustment foot traffic of 8,955 and sales of 920,000 yuan, a 272% year-on-year increase.

Interestingly, Pang Donglai provides these services without charging any “consultation fees”, even covering its own travel expenses. This generosity has sparked debates about the true nature of this assistance.

For Pang Dong Lai, this is a strategic move to gain national recognition and expand its own brand presence across China. Pang Dong Lai is building an alliance centered around its “Lianshang Donglai Business Research Institute”…

The report uses Consumer Reach Points (CRPs) as a metric to identify the brands most chosen by consumers globally and those with the fastest growth.

Key Findings from the Report:

Top Brands: Yili, Mengniu, Master Kong, and Haitian remain the top four consumer choices, with Uni-President re-entering the top ten list.

New Entrant: Baixiang has made it into the top 50 for the first time, becoming the fastest-growing brand.

Consumer Preferences: In 2023, there was a notable shift in consumer purchasing preferences, with beverages accounting for six of the top ten categories for attracting new consumers.

Brand Growth: Reaching more consumers remains the cornerstone of brand growth, with major brands maintaining a dominant position in the top 50.

Meaningful Differentiation: Successful brands have created meaningful differentiation in consumers’ minds, enhancing their presence and finding new growth opportunities, thus increasing their penetration rates.

Functional beverages, in particular, have seen a substantial increase in penetration rate, attracting 11.7 million new consumer households. This trend underscores the growing consumer interest in health and wellness products that offer functional benefits.

Read the full article here (subscribers).

BRIEF BLASTS

🚀 SenseTime unveiled SenseNova 5.5 at WAIC 2024, introducing China's first real-time multimodal model, SenseNova 5o. This upgrade boosts AI interaction, cuts edge-device costs to RMB 9.90/year, and adds new tools like the Vimi AI avatar video generator and Code Raccoon productivity tool. The "Project $0 Go" aids enterprises shifting from OpenAI.

The latest report from Kantar BrandZ, “2024 China’s Top 50 Global Brands,” highlights the dynamic growth and global reach of Chinese brands. ByteDance, Xiaomi, and SHEIN lead the list, showcasing the strength of Chinese brands in the entertainment, electronics, and fashion sectors. Lenovo, Huawei, and AliExpress also remain strong contenders, emphasizing the diversity and innovation in China’s tech and e-commerce industries.

China continues to dominate the global EV market, followed by the United States and Europe. In the first quarter of 2024, China’s EV sales increased by a substantial 28% year-over-year, whereas the United States saw a modest 2% increase. Despite overall growth in the U.S. market, pure electric vehicle sales declined by 3%.

According to IDC’s latest data, China’s AR/VR headset shipments totaled 107,000 units in the first quarter of 2024, representing a significant year-over-year decline of 37.8%. Despite this downturn, the market shows signs of potential recovery in the latter half of the year.

China’s wearable device market experienced remarkable growth in the first quarter of 2024, outpacing the global market by a significant margin. The market’s shipment volume reached 33.67 million units, representing a year-over-year increase of 36.2%. This rapid growth rate is nearly four times the global average.