- CIW News

- Posts

- 29 Aug 2024

29 Aug 2024

CIW News is a free email newsletter on China tech trends.

ARTIFICIAL INTELLIGENCE

China’s Generative AI Market Ecosystem Overview

The generative AI ecosystem in China is currently dominated by three primary groups:

Top Internet Companies: Giants like Baidu, Alibaba, Tencent, and ByteDance are leading the charge, leveraging their vast resources to develop and integrate generative AI across various applications.

New AI Unicorns: Emerging startups such as Zhipu AI, MoonShadow, and Baichuan Intelligent are pushing the boundaries of AI innovation, particularly in niche and specialized areas.

Traditional AI Enterprises: Established players like SenseTime, CloudWalk, and iFlytek are adapting to the generative AI wave, building upon their existing expertise to create robust AI models and solutions.

Read more:

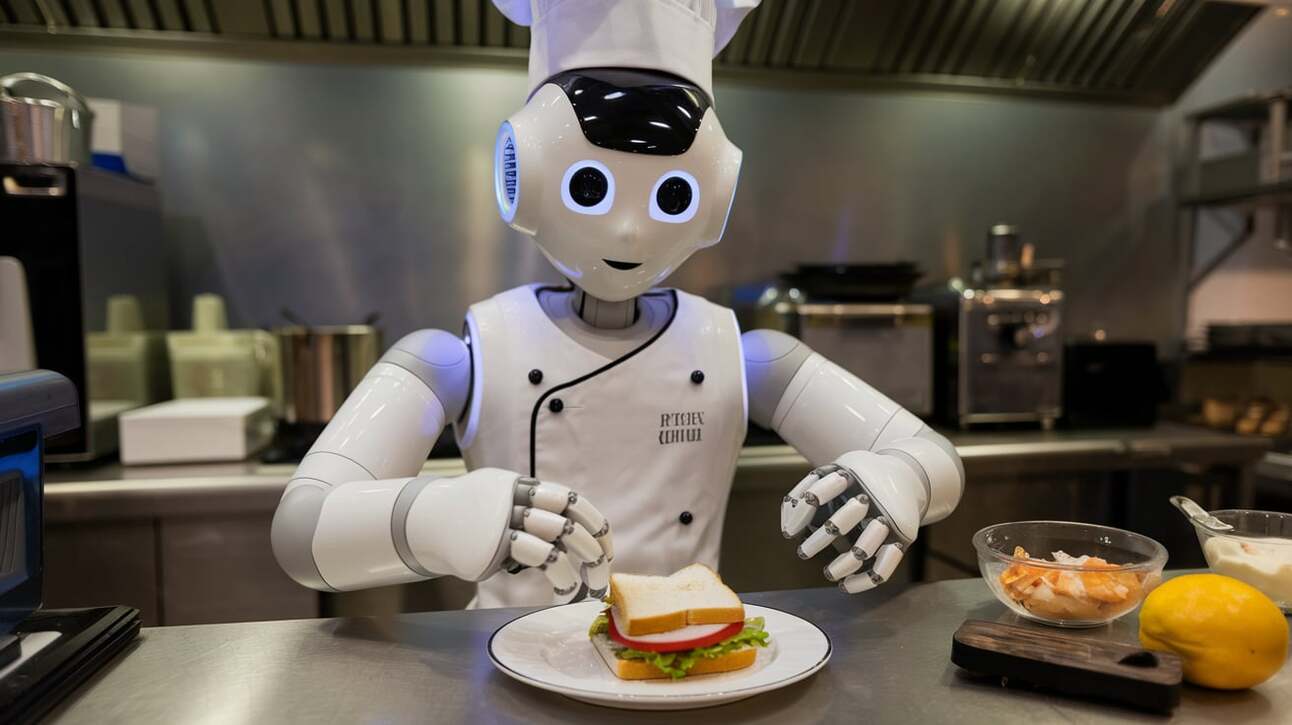

China’s domestic cooking robotics market, though still in its nascent stages, is witnessing significant growth, according to recent data from Aowei Cloud. In the first half of 2024, online sales revenue for cooking robots reached RMB 130 million (approximately USD 17.8 million), marking a robust year-on-year increase of 41.2%.

Sales volume surged even more impressively, with 67,000 units sold, representing an 82.1% growth compared to the same period last year.

Price remains a significant factor in the purchasing decision for many consumers. The most popular price range for these products is between RMB 4,000 and RMB 5,000, which accounts for 31% of total sales revenue…

Sign in to read this full article for subscribers. And, find out the top 3 Chinese apps in global AI apps market.

In the first half of 2024, the Chinese passenger vehicle market witnessed significant developments in the automotive cockpit chip sector.

Huawei HiSilicon, a domestic brand, made a remarkable entry into the top ten list of cockpit chip suppliers, securing its position with a delivery volume of 225,898 units and a market share of 1.42%.

Read more on the top 10 with a paid subscription.

In recent times, the controversy surrounding the “refund only” policy on Chinese e-commerce platforms has sparked considerable debate. Some merchants have publicly voiced their frustrations, accusing the policy of being exploited by so-called “bargain hunters”, leading to what they describe as malicious refund practices.

However, a closer examination reveals that even for those merchants who have spoken out, the proportion of “refund only” orders remains in the single digits.

What was originally intended as a policy to protect consumers and combat substandard merchants has now become a flashpoint for conflict, raising the question: why has this policy become the “final straw” for some merchants?

Read more: among Taotian (Alibaba), JD.com, and Pinduoduo, which operating cost component is the most significant burden for merchants?

Recently, many brands selling adult toys and lingerie have ventured into live streaming on platforms like Xiaohongshu (Little Red Book or RED), with a notable increase in female-oriented products.

These live streams, much like those for beauty and fashion, are brightly lit and tastefully designed, with hosts discussing various products as if they were ordinary household items.

These sexual wellness products often have playful names like “rabbit” or “seal,” and discussions replace anatomical terms with euphemisms. If one doesn’t listen closely, it might be hard to identify these products as sexual wellness items at first glance.

E-commerce platforms are hungry for traffic, and sexual wellness brands are becoming an attractive target. Sexual wellness industry in China is steadily growing, with the market expected to reach 208.13 billion yuan by 2025.

This year, platforms like Kuaishou and Xiaohongshu have adjusted their entry barriers for sexual wellness brands. Read the full article with a subscription.

BRIEF BLASTS

The World Robot Conference in Beijing highlighted China's efforts to lead in humanoid robot technology.

Chinese companies are showcasing innovative components that lower production costs significantly.

Wisson Technology (Shenzhen) employs 3D-printed plastics and pneumatic artificial muscles, allowing its robotic arms to be priced at about one-tenth of traditional robotic arms.

Yi Gang, founder of Ti5 Robot, noted concerns about product reliability within the robotics supply chain, limiting production volumes to about 1,000 due to defect rates.

The country’s robotics market is the largest globally and is transforming traditional sectors like manufacturing, automotive, agriculture, education, and healthcare.

The National Bureau of Statistics (NBS) of China has released data indicating a significant increase in online retail sales in the first half of 2024. The total online retail sales reached 7.0991 trillion RMB (US$981 billion), marking a 9.8% year-on-year growth.

China smartphone market saw a year-over-year (YoY) growth of 8.9% in Q2, with total shipments reaching approximately 71.6 million units. This marks the third consecutive quarter of growth, bringing the total shipments for the first half of 2024 to 140.8 million units, a 7.7% increase from the previous year.

Alibaba Group released its financial results for the quarter ending June 30, 2024, showcasing both growth in strategic areas and challenges in maintaining profitability. The company continues to focus on its core businesses, particularly cloud computing and international expansion, while navigating a complex economic landscape.

Tencent reported a substantial year-on-year increase in total user time spent on WeChat Video Accounts, driven by enhanced recommendation algorithms and an expanded array of local content. The company is systematically strengthening transaction capabilities within this platform to deliver seamless shopping experiences, thereby driving sales for merchants. The total user time spent on Mini Programs also grew by over 20%.

In the second quarter, JD Retail strengthened its market position by entering into strategic partnerships with prominent brands like Xiaomi, Lenovo, OPPO, and luxury fashion houses including MONCLER and alexanderwang.