- CIW News

- Posts

- CIW News 4 Apr

CIW News 4 Apr

AI Experts: China vs. USA

CIW Weekly, is now CIW News, an email newsletter on China tech trends.

Join us as we navigate through the bustling digital streets of China's internet economy, uncovering insights and strategies that are setting the pace for the global digital future. Let’s dive in…

Forecasts predict a staggering $260 billion contribution from 5G to China’s GDP by 2030, underscoring a vital 23% of the annual economic impact attributed to the mobile sector.

The landscape of mobile service usage in China presents a tale of exponential growth, with 1.3 billion individuals, 88% of the populace, embracing mobile services since 2015. This saturation signals a near plateau in adoption rates, with a forecasted steady state through 2030.

Contrastingly, the mobile internet adoption spectrum is witnessing a pronounced shift, with an anticipated surge of 70 million new users by 2030, elevating adoption rates to 89%. This evolution hints at narrowing digital divides, primarily benefiting the youth and the elderly.

CLOUD COMPUTING

China’s Cloud Infrastructure Services Surge to $9.7 Billion

China’s cloud infrastructure services spending soared to $9.7 billion in Q4 2023, marking a 22% year-over-year increase and capturing 12% of the global cloud expenditure.

Throughout 2023, China’s cloud market witnessed a 16% growth, a notable rise from 2022’s 10%. This momentum is expected to continue, with forecasts predicting an 18% growth in 2024.

In the final quarter of 2023, Alibaba Cloud, Huawei Cloud, and Tencent Cloud—China’s leading cloud service providers—dominated the market, collectively achieving a 28% growth and securing a 74% market share.

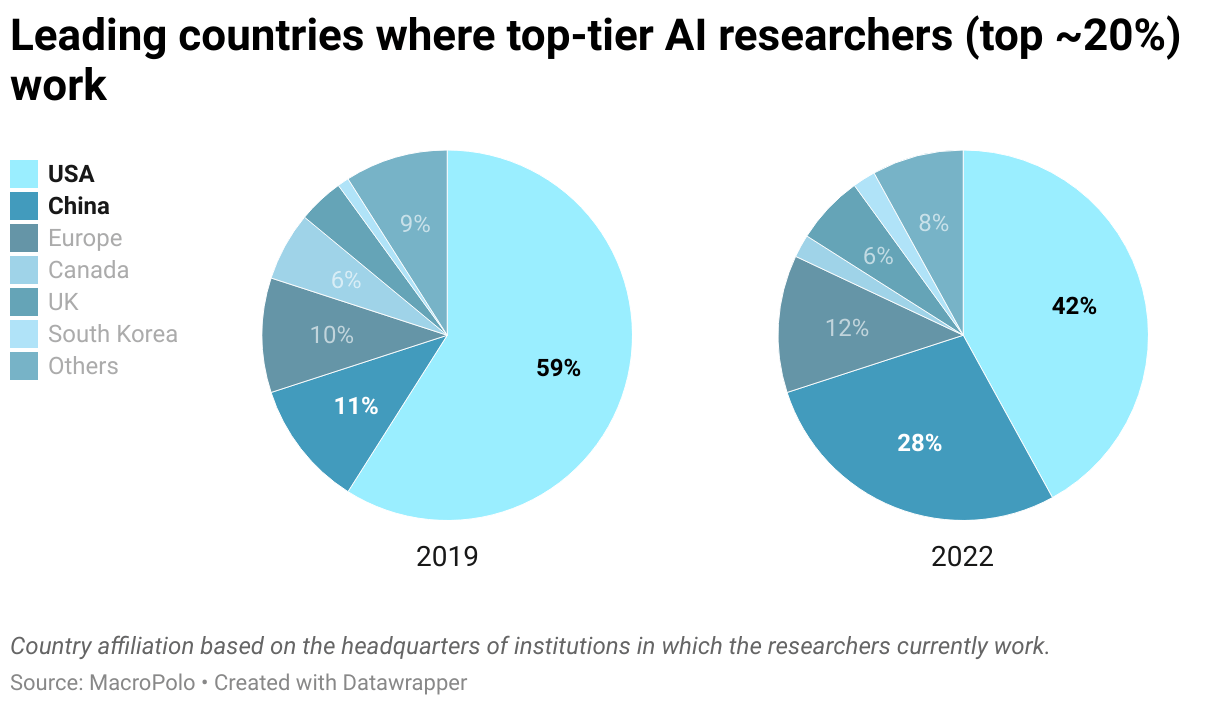

80% of AI researchers stay in the country where they completed their graduate degree. The US still attracts the most AI talent, but China's share is increasing.

More top-tier AI researchers are choosing to work in their home countries, indicating a shift in brain drain dynamics.

CIW SUBSCRIPTION

China Digital Landscape 2024 – Entertainment

In 2023, China’s digital content sectors, encompassing online video, live streaming, music, and literature, showcased remarkable growth and innovation.

The online video user base expanded to 1.067 billion, with substantial improvements in content variety, especially in micro and short dramas, supported by government guidelines and quality initiatives.

Live streaming also saw a significant increase in users, reaching 816 million, with diverse content areas including e-commerce and gaming, reflecting enhanced regulatory standards and user experience optimization.

The online music sector experienced a notable rise in paid subscriptions and revenue, reaching 715 million users, thanks to strengthened copyright protection and industry collaboration.

Meanwhile, the online literature user base grew to 520 million, buoyed by international expansion and the integration of AI technologies to boost creative efficiency. Across these sectors, China’s focus on quality, regulation, and technological integration is driving a vibrant digital culture and economy.

Read the full article here (subscribers only).

BRIEF BLASTS

🛍️ Douyin, known as TikTok outside of China, has launched a new app dedicated to shopping named Douyin Mall. This platform aims to establish a distinct brand identity for Douyin's e-commerce functionalities, highlighting ultra-low priced products and strategic priorities for enhancing user shopping experience. The app integrates short video content, but lacks video shooting and editing features, ensuring users' content preferences are synchronized across both platforms for seamless browsing and shopping.

💰 Taobao is increasing subsidies and cutting fees for merchants, introducing a 10 billion yuan initiative for content creation to maintain its leading position in China's competitive e-commerce landscape. The platform is waiving certain service fees and aims to focus more on its core businesses, e-commerce and cloud computing, amid slowing growth in its main businesses.

🚀 Alibaba is experimenting with a rocket parcel delivery service named XZY-1, aiming to deliver goods anywhere in the world within an hour. This ambitious project is in collaboration with Space Epoch, focusing on a reusable rocket that can land on the sea. While achieving this goal may not be immediate, it represents a significant step towards enhancing Alibaba's logistics capabilities globally.

Huawei’s net profit rose dramatically to about USD 12.28 billion, illustrating Huawei’s effective management and strategic realignment in response to external pressures and market dynamics.

📈 China's investment in the Generative AI sector is expected to surge, with projections reaching $13 billion by 2027. This represents a compound annual growth rate (CAGR) of 86.2% from 2022 to 2027, highlighting the rapid technological advancement and government support for AI development in the country. China's growing emphasis on AI innovation is set to significantly contribute to the global AI market, positioning the nation as a leading player in the industry.

🔍 China has introduced AI regulations to counteract misinformation, showcasing its commitment to managing the ethical challenges posed by artificial intelligence. The new legislation is aimed at curbing the spread of fake news and ensuring the responsible development and deployment of AI technologies, setting a precedent for how countries might navigate the complex landscape of AI governance.

💳 ByteDance, the owner of TikTok, has acquired Chinese payments company UIPay to enhance its domestic payment capabilities. This move is seen as a strategy to diversify ByteDance's business operations in China, supplementing its existing major payment options and aiming to improve user experience across its platforms.

🛑 Tencent has been fined 1 million yuan by China's cyberspace regulator for hosting illegal and pornographic content. The company accepted the penalty and pledged to take corrective actions, reflecting the broader push for stricter internet regulation and a safer online environment in China.

🚨 Alibaba has signaled concern over Hong Kong's market conditions by cancelling plans to list its logistics unit, Cainiao, and offering a buyout to minority shareholders. This decision reflects challenges faced by Hong Kong's financial market and may indicate a broader hesitation among companies to pursue IPOs in the current economic and regulatory climate.