- CIW News

- Posts

- DeepSeek and Wang Wenfeng

DeepSeek and Wang Wenfeng

CIW News is a free email newsletter on China tech trends.

ARTIFICIAL INTELLIGENCE

DeepSeek and Wang Wenfeng: A Disruptor in China’s AI Industry

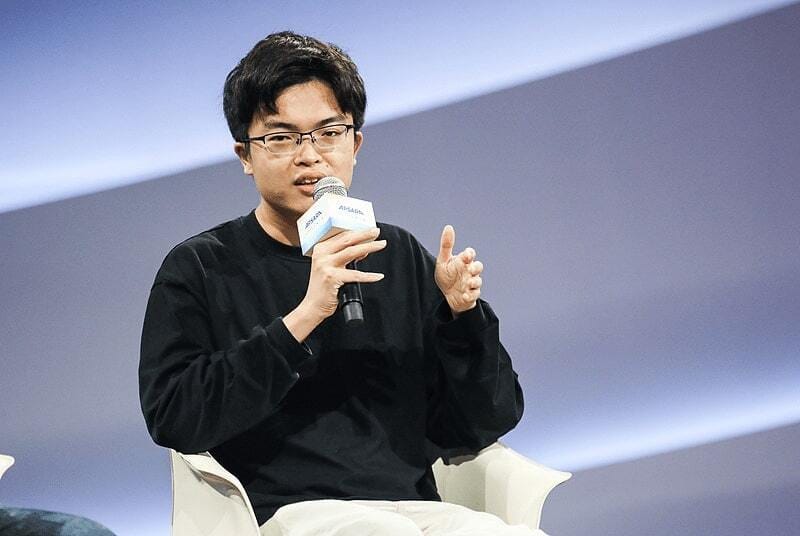

DeepSeek founder Wang Wenfeng

Wang Wenfeng, founder of DeepSeek, has emerged as a key figure in China's artificial intelligence sector. Unlike many entrepreneurs focused on commercializing AI, Wang has prioritized fundamental research, pushing China's AI development beyond imitation towards original innovation.

Born in 1985 in Zhanjiang, Guangdong, Wang demonstrated early academic excellence, securing a place at Zhejiang University at 17.

He later co-founded High-Flyer Quant, one of China’s leading AI-driven hedge funds. In 2023, he launched DeepSeek with the goal of achieving artificial general intelligence (AGI), rather than focusing solely on applications.

DeepSeek’s V2 model release triggered a pricing war in China’s AI industry, forcing major players like ByteDance, Tencent, and Alibaba to lower their prices. Wang insists this was unintentional, explaining that DeepSeek simply set prices based on cost without subsidies or profit-driven motives.

While many Chinese AI firms have followed Meta’s Llama structure, DeepSeek has focused on fundamental innovation. Wang’s team developed the Multi-Head Latent Attention (MLA) mechanism, significantly reducing computational costs. He estimates that China’s AI models require four times the compute power of U.S. counterparts, a gap DeepSeek aims to close.

Unlike China’s tech giants, which prioritize quick commercialization, DeepSeek fosters a research-first culture. The company operates on a flat management structure, empowering engineers with full access to computing resources. Wang believes AI advancements should be open and widely accessible.

DeepSeek’s ultimate goal is AGI, with large language models (LLMs) serving as a stepping stone. Wang sees AGI as achievable within his lifetime, and DeepSeek remains focused on foundational research rather than building commercial applications.

If you have a valid CIW paid subscription, read the full version here.

More on China tech:

IDC reports that China’s Model-as-a-Service (MaaS) market reached RMB 2.5 billion in the first half of 2024.

According to IDC’s latest study, China Model-as-a-Service (MaaS) and AI Large Model Solutions Market sector is forecast to maintain robust momentum through 2028, with a projected compound annual growth rate (CAGR) of 64.8%. By 2028, the MaaS market is expected to hit RMB 3.8 billion.

By 2028, IDC forecasts that China’s MaaS market will climb to RMB 3.8 billion, while AI large model solutions may surpass RMB 21.1 billion—turning large-model-based AI into a cornerstone of next-generation innovation.

Read more on e-commerce:

Decoding the “Reverse Haitao” Phenomenon: Why Global Consumers are Flocking to Chinese E-Commerce

Pinduoduo Surpasses Taobao in User Engagement During Double 11, While Taobao Leads in Daily Active Users

At the 2025 WeChat Open Class on January 9, WeChat announced plans to deepen the integration of its “WeChat Mini Store” (Xiaodian) platform with push-based distribution, signaling a new growth trajectory for private domain e-commerce.

Push-based distribution refers to a sales model where distributors, also known as “pushers” or “regiment leaders,” actively promote products through various channels within the WeChat ecosystem.

The initiative positions WeChat Mini Stores (Weixin Xiaodian) as the cornerstone of the ecosystem, encouraging merchants to adopt the platform and leverage push distribution to promote products through public accounts, video channels, mini-programs, Moments, and group chats. This approach offers businesses the potential for exponential sales growth.

Read the article here.

More on social media:

As the curtains close on a turbulent 2024 marked by global economic headwinds and widespread fatigue, many brands, marketers, and consumers find themselves looking ahead to 2025 with cautious optimism.

Economic indicators suggest a modest rebound—what some analysts are calling a “wobbly recovery.” However, from the reemergence of brand advertising to the proliferation of AI-driven creative content, the year ahead is likely to usher in a variety of nuanced shifts rather than a dramatic turnaround.

Here are ten key marketing trends poised to define 2025, drawn from industry data, consumer behavior surveys, and the evolving realities of an uncertain global marketplace.

Read the full article with a subscription.