- CIW News

- Posts

- top mobile apps in q1

top mobile apps in q1

CIW News is a free email newsletter on China tech trends.

GENERATIVE AI

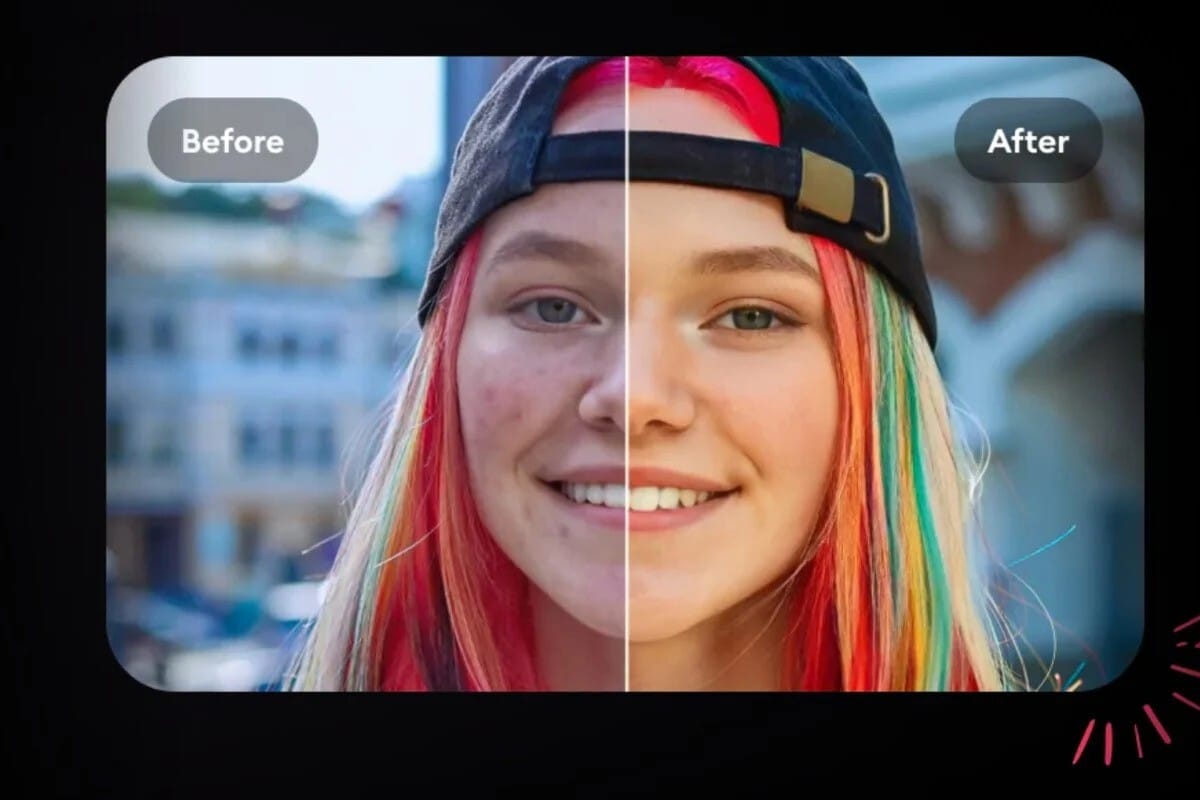

AI photo enhancer Remini is the latest hot app in China, surpassing TikTok’s sister platform Douyin

📱 Remini, an AI photo enhancer, has become immensely popular in China, surpassing even TikTok's sister platform Douyin in downloads.

📸 The app's features include unblurring old photos and creating clay-style portraits, which have gained traction among Chinese users.

📈 Remini's popularity surged during China's five-day Labour Day holiday, with netizens sharing enhanced photos on social media platforms.

💰 After a free trial, users must pay at least 8 yuan (US$1.1) to continue using Remini, with advanced features like the clay effect costing 68 yuan per week.

MOBILE APPS | SUBSCRIPTION

Top 50 Mobile Apps in China in Q1 2024

China’s mobile internet is booming, with active users surging past 1.23 billion in March 2024, a jump of over 20 million year-on-year, according to QuestMobile.

Unsurprisingly, Tencent’s WeChat reigns supreme, towering over the competition with over 1 billion MAU. It’s the only app to breach the 1 billion user mark, solidifying its status as the undisputed king of China’s mobile ecosystem.

Short Video’s Reign: Douyin (TikTok) and Xigua Video command massive user bases, highlighting the continued popularity of short-form video content.

E-commerce Giants: The presence of Taobao, Pinduoduo, JD.com, and Vipshop underscores the vibrancy of China’s e-commerce sector.

Digital Life Essentials: Apps like Alipay, Meituan, Didi Chuxing, and Ele.me reflect the integration of digital services into everyday life, from payments and food delivery to transportation and local services.

See the full list with a subscription.

ARTIFICIAL INTELLIGENCE

Alibaba leverages cloud business to become a leading AI investor in China

💡 Alibaba is leveraging its cloud computing infrastructure to invest in China's AI start-ups. Instead of cash-for-equity funding, Alibaba offers computing resources to these start-ups.

🚀 Alibaba aims to replicate the success of Microsoft's investment in OpenAI by investing in local AI start-ups.

🔍 Moonshot AI, Zhipu, MiniMax, and 01.ai are among the start-ups receiving investments from Alibaba. Alibaba's CEO Eddie Yongming Wu is personally overseeing investments in these AI start-ups.

🔄 The investment comes as Alibaba seeks to reinvent itself as an AI innovator amidst rising competition. Alibaba's cloud arm's profitability lags behind US rivals like AWS, prompting a focus on AI investments.

SOCIAL MEDIA

Tencent’s Impressive Q1 2024 Financial Performance Sets Strong Foundation for Future Growth

📈 Tencent Holdings Limited reported robust growth in gross profit and net profit for Q1 2024.

📱 WeChat Video Accounts experienced a significant increase in user engagement, with total user time spent rising by over 80% year-over-year.

🔄 Mini Programs, a staple feature of WeChat, reported a 20% increase in user engagement, showcasing Tencent's continuous innovation.

💰 Tencent's financial highlights for Q1 2024 include a 6% year-over-year increase in total revenues and a 54% increase in net profit attributable to equity holders.

💼 Alibaba reported a 7% revenue growth in Q1 2024. Net income dropped by 96% mainly due to investment losses.

🎯 Strategic initiatives across e-commerce, cloud computing, and international commerce drove growth.

🛒 Taobao and Tmall Group saw a 4% revenue growth, reaching RMB 93.2 billion.

☁️ Cloud Intelligence Group reported a 3% revenue increase, reaching RMB 25.6 billion.

Also read: top e-commerce apps in Q1

The Chinese coffee industry has experienced rapid growth, reaching a market size of $38.5 billion in 2023.

Per capita coffee consumption in China stood at 16.74 cups in 2023, indicating a significant shift in consumer preferences.

Shanghai leads the coffee boom in China, hosting the highest number of coffee shops in the nation.

The import value of coffee-related goods reached $1.13 billion in 2023, showcasing increasing domestic demand for quality coffee products.

BRIEF BLASTS

🌐 While Western markets embraced KYC and regulation, Chinese users adapted to unregulated crypto platforms. This divergence was evident at Bitcoin Asia 2024, showcasing a market free from centralized exchanges and fiat operators.

Top envoys from the U.S. and China met in Geneva to discuss AI technologies and their potential risks, marking the start of a new bilateral dialogue on AI agreed upon by Presidents Biden and Xi in 2023.

The Biden administration plans to impose guardrails on U.S.-developed AI models, like ChatGPT, to safeguard against misuse by countries such as China and Russia. Despite these restrictions, China has been developing its own generative AI industry, encouraging companies to avoid foreign technology.

📉Despite initial enthusiasm, Hong Kong's bitcoin ETFs experienced significant net outflows recently. Meanwhile, Wall Street's bitcoin ETFs have also seen fluctuating volumes, indicating mixed investor sentiment. Analysts predict short-term dips but remain optimistic about bitcoin's long-term growth, with expectations of prices reaching around $92,000 per bitcoin.

Few Chinese-made EVs are currently sold in the United States, so the immediate impact on consumers of higher EV tariffs would be minimal, analysts said. The White House also plans to more than triple tariffs on Chinese EV batteries and battery parts to 25%. Graphite, permanent magnets used in EV motors and other EV minerals would get new 25% duties added. These tariffs could affect a broader range of vehicles.